Pool Staking

Pool Staking

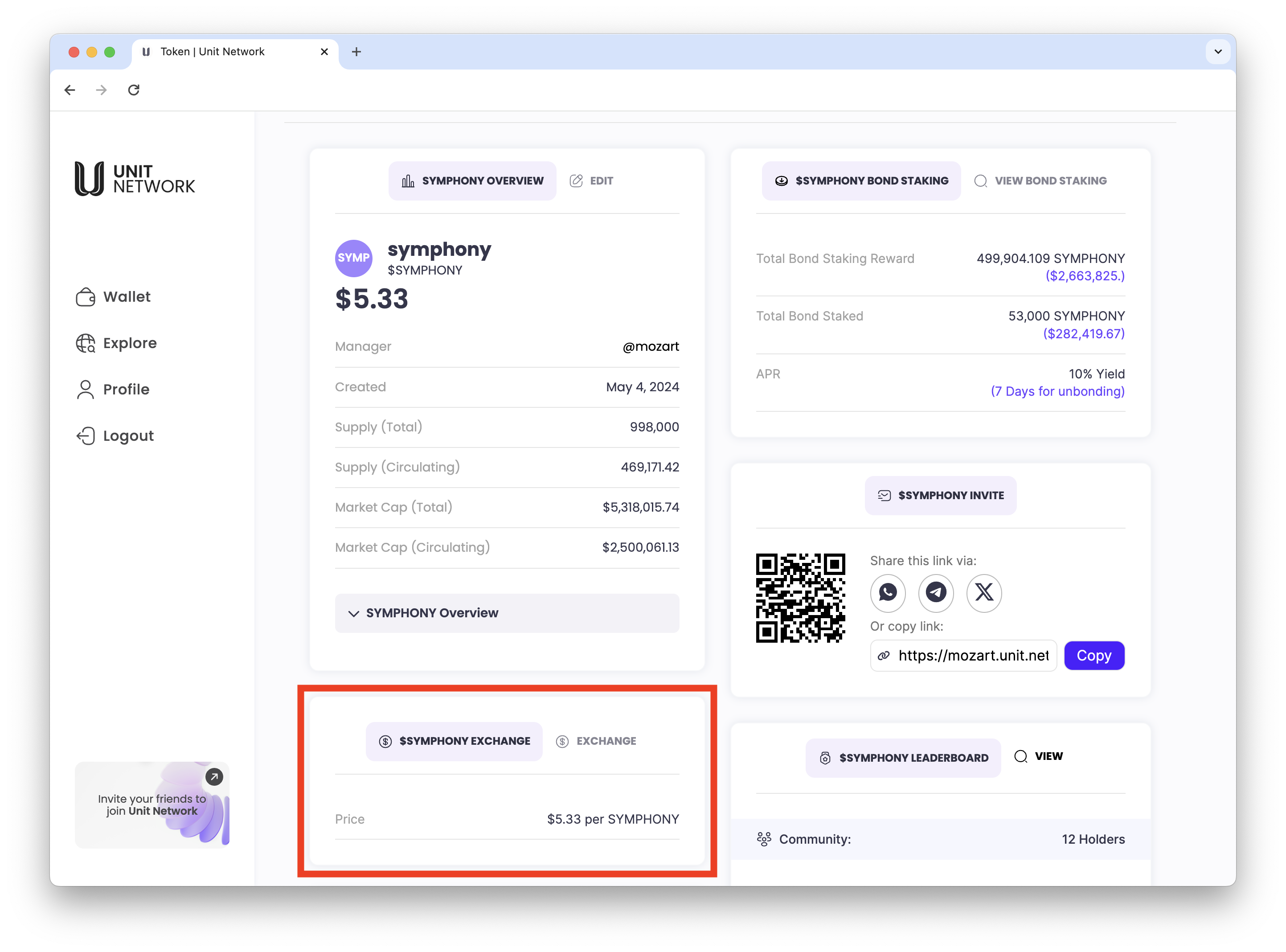

The Token Bank panel provide detailed information of Token.

Providing Liquidity:

Exchange Pool Stakers, also known as liquidity providers (LPs), contribute an equal value of two tokens (e.g., Token A and Token B) to a liquidity pool. This facilitates efficient trading between the paired tokens on the DEX.

The Liquidity Pool panel can be viewed within the Exchange dashboard.

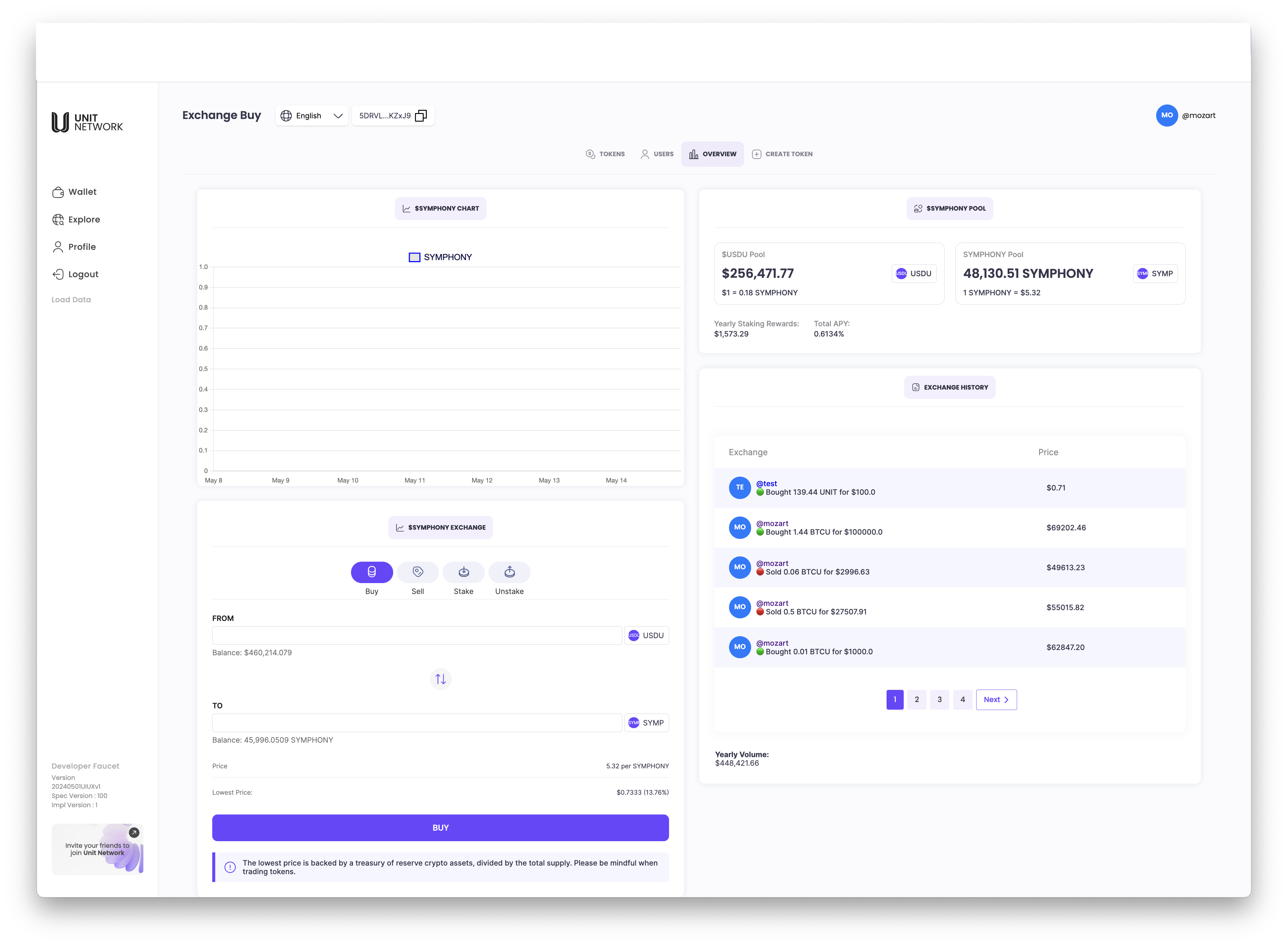

Pool Staking Dashboard

There are five panels in the Pool Staking Dashboard.

- Exchange LP Staking Panel

- Token Pool Overview Panel

- Token Pool Ownership panel

- Staking History Panel

- Exchange Staked Panel

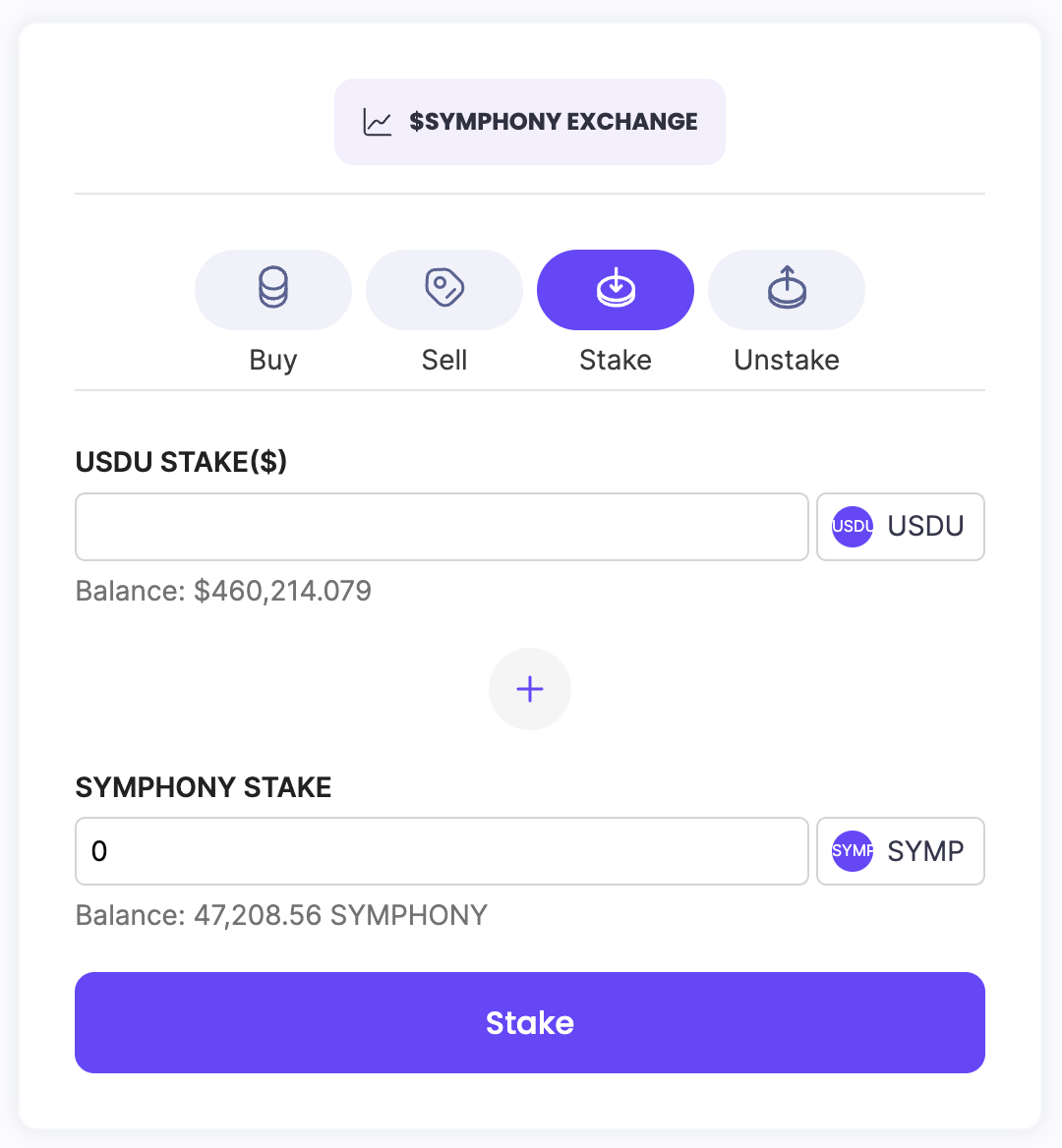

Exchange LP Staking Panel

When a token owner first create the token, the token has no value. To create value, the token owner needs to add Liquidity into the Liquidity Pool.

In this example, the token owner set up liquidity to value at $1.00 per token.

Exchange LP UNStaking Panel

To unstake and remove liquidity, navigate to exchange panel and select Unstake.

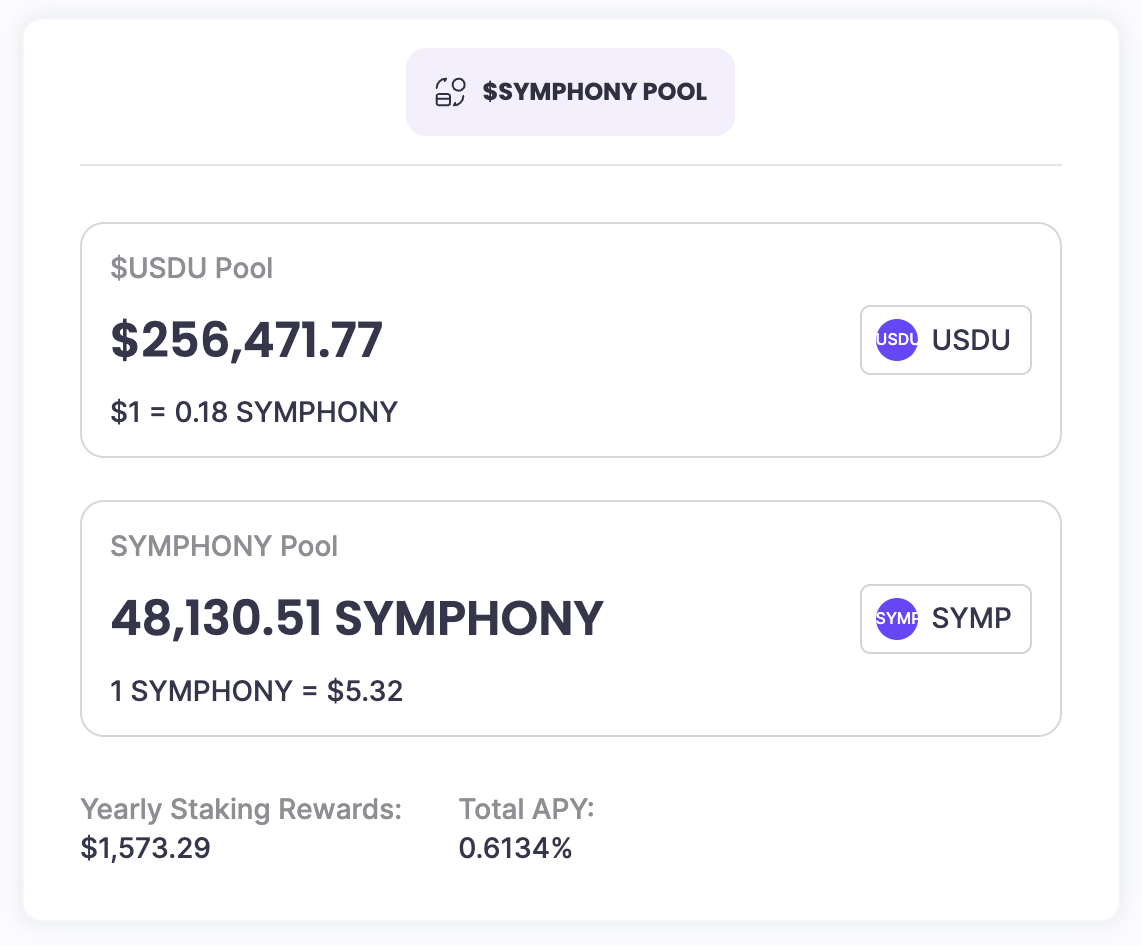

Pool Overview Panel

The Pool Overview panel display the current price of the token pair :

Pool staking rewards is calculated based on fees which have been paid to liquidity providers in the past year. Divide that by total amount liquidity staked.

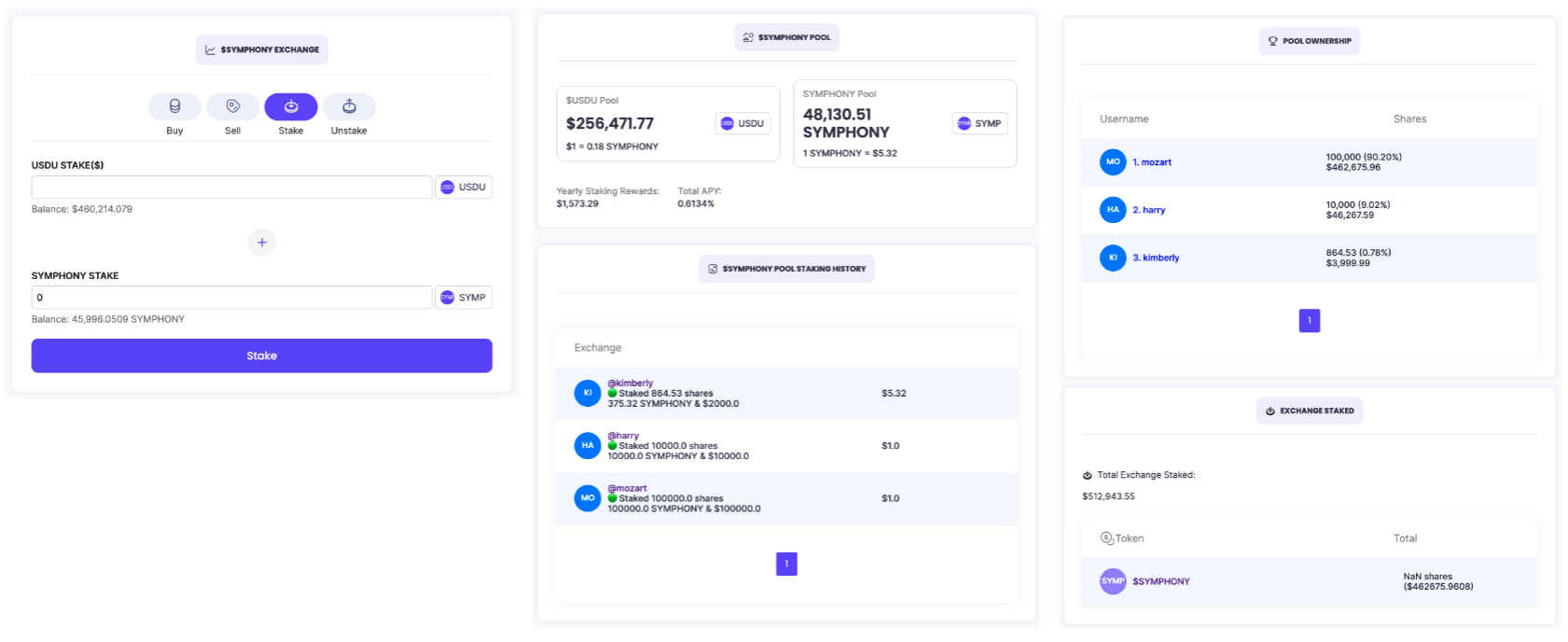

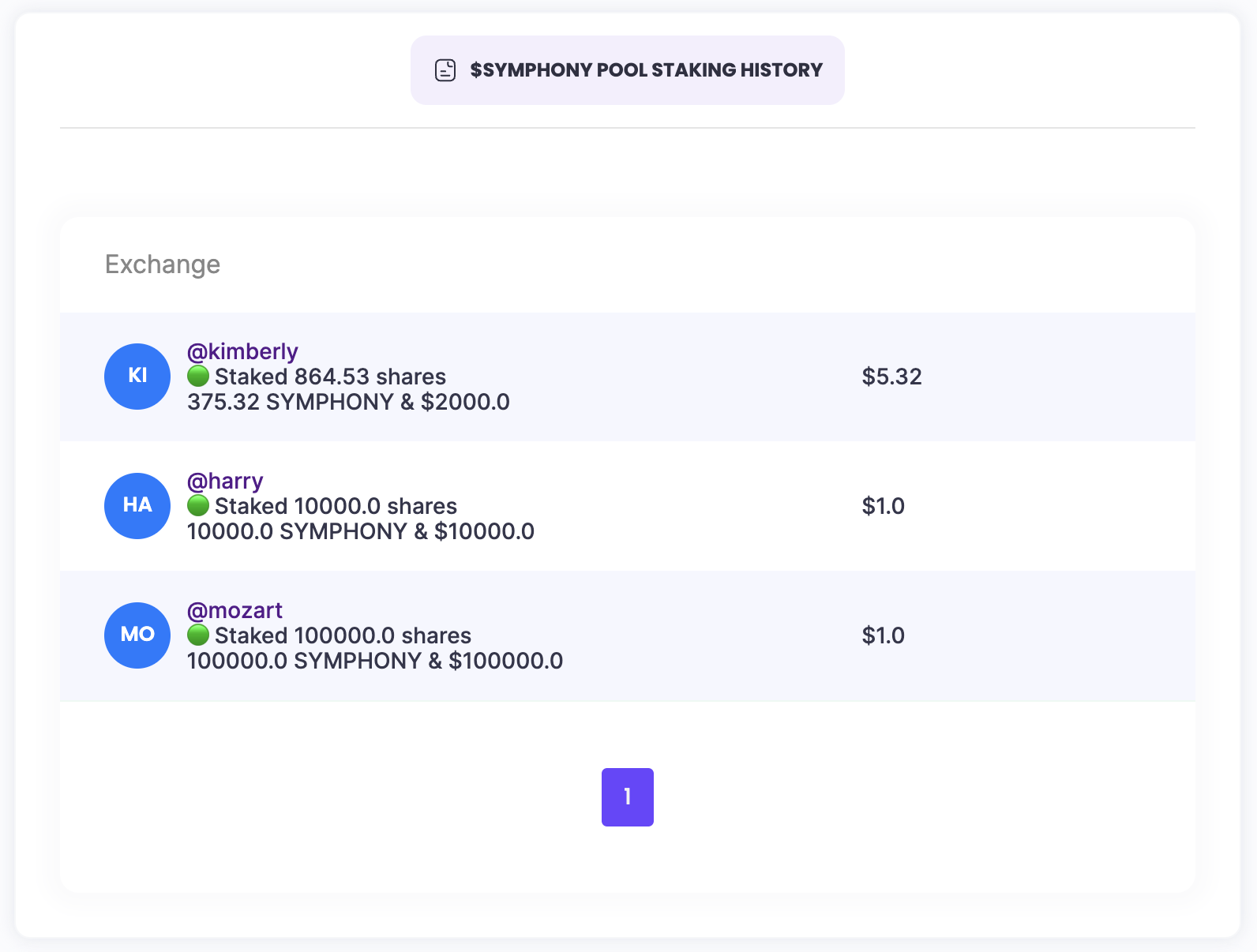

Staking History Panel

The Staking History panel display the listing of transactions by Liquidity Providers.

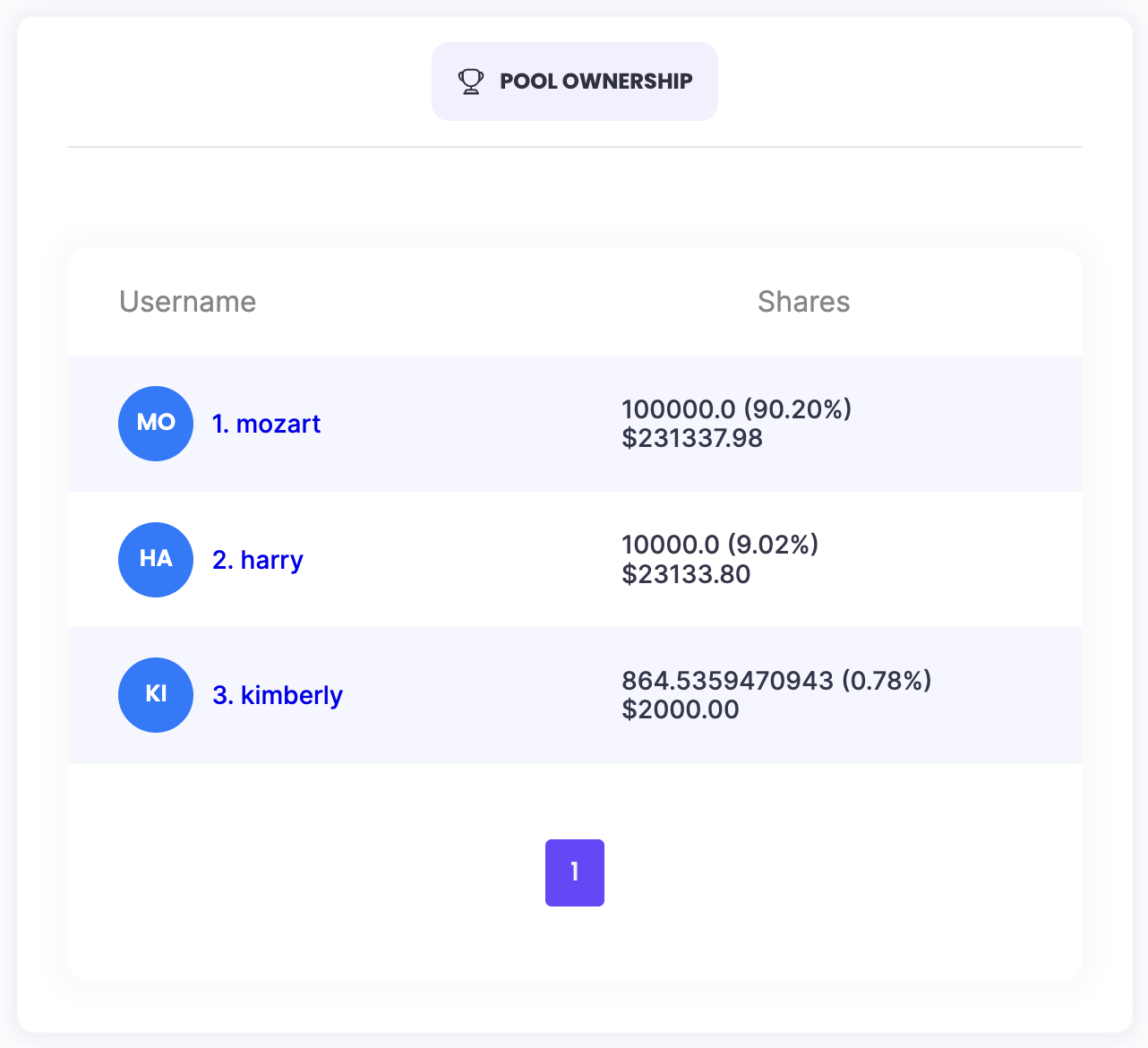

Pool Ownership panel

The Pool Ownership panel d isplay the Liquidity Providers and percentage of ownership.

In the pool leaderboard, the display shows the stakers for a particular token and display the number of shares that he has, the percentage of the total shares minted, and below, the amount of USD the shares worth (value of tokens * USD staked)

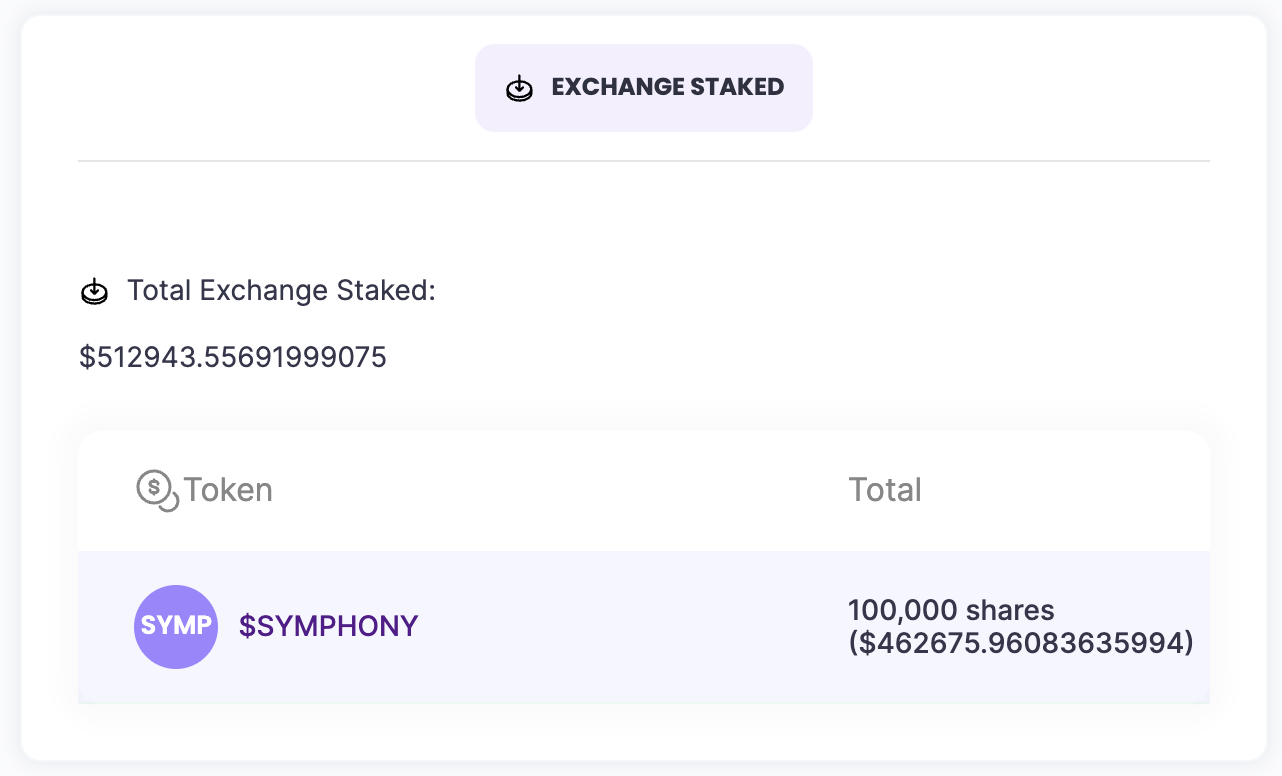

Exchange Staked Panel

Total Exchange Staked : the total value of the shares (value of all the tokens staked + total USD staked)

Listing: Display the number of shares the user owns.