Treasury

Industries Token Treasury

The Industries Token Treasury panel provide detailed information of Industries Token.

The Treasury is where retained earnings go, and it sets a lowest price for the token.

Tokens deposited into the treasury can only be removed by token holders in a redemption.

Increase in value in Treasury will increase the price support for the token. This will also result in more confidence in the token.

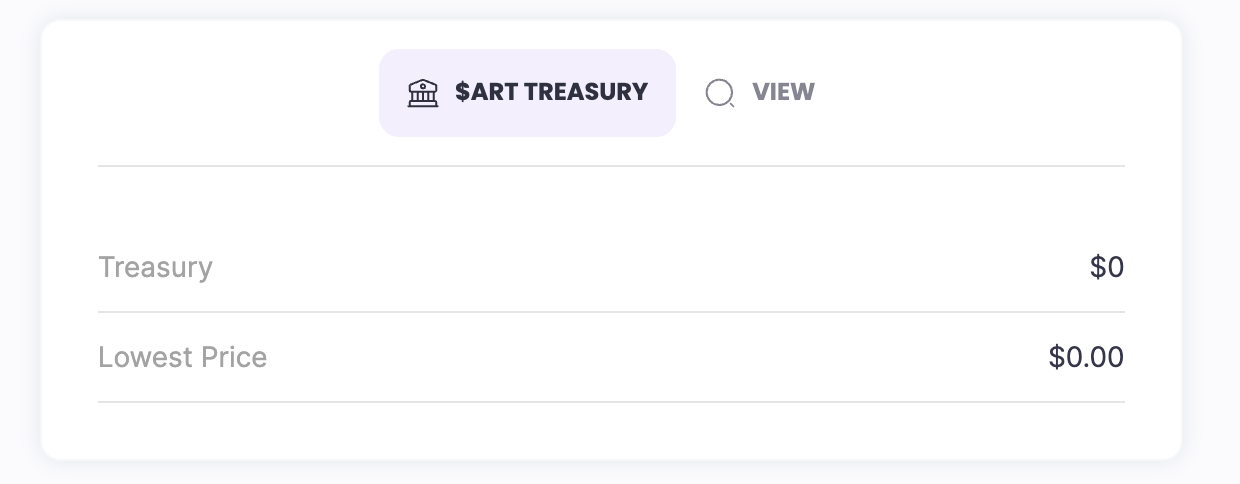

Treasury panel - Initial value

Before a token is active, the treasury will not have any value.

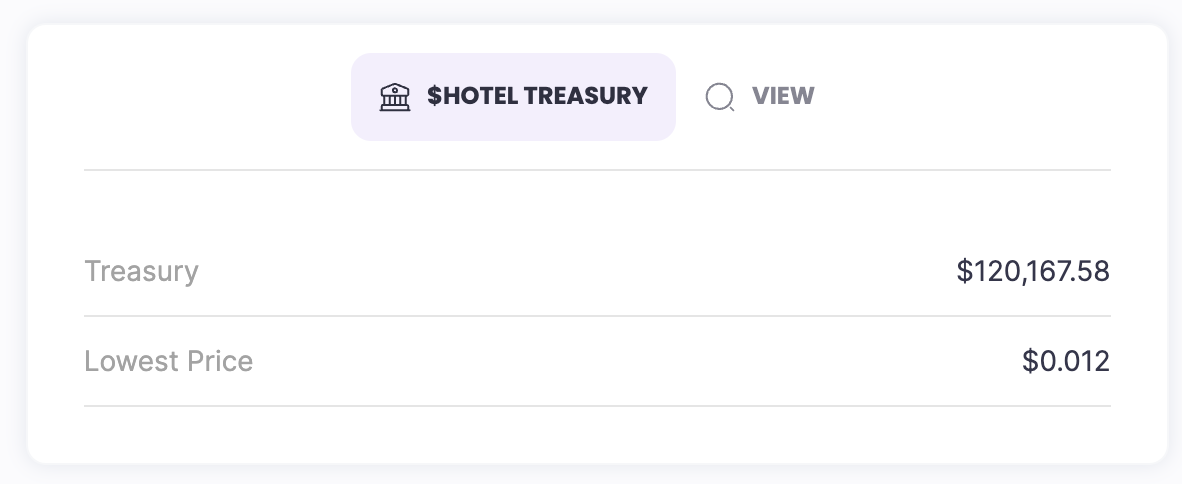

Treasury panel - Growth

When a Industries token is activated (sales round) and there are successful sales, the sales collection is deposited into the treasury.

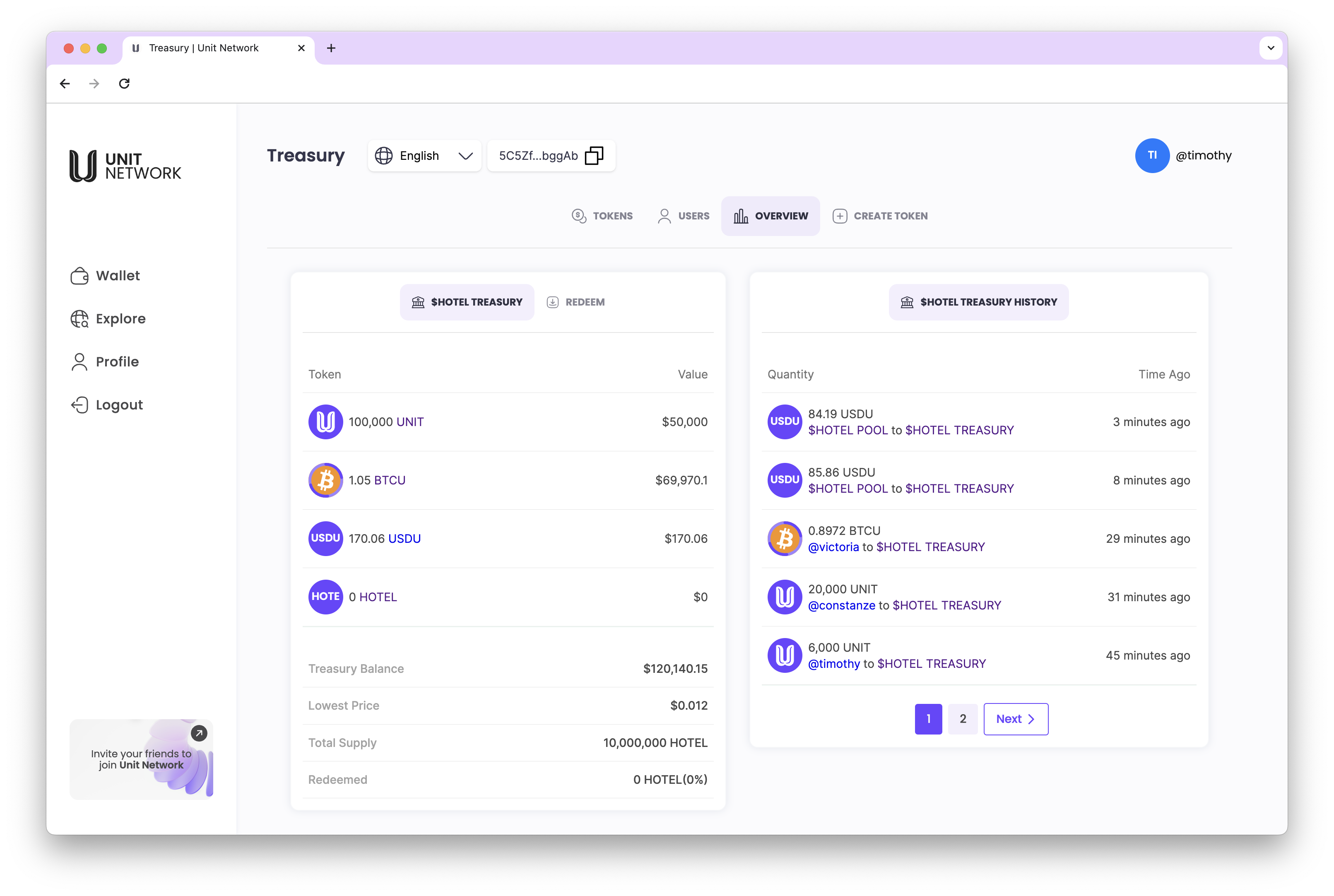

Treasury Dashboard

The treasury dashboard has 2 panels:

- Treasury Overview

- Treasury History

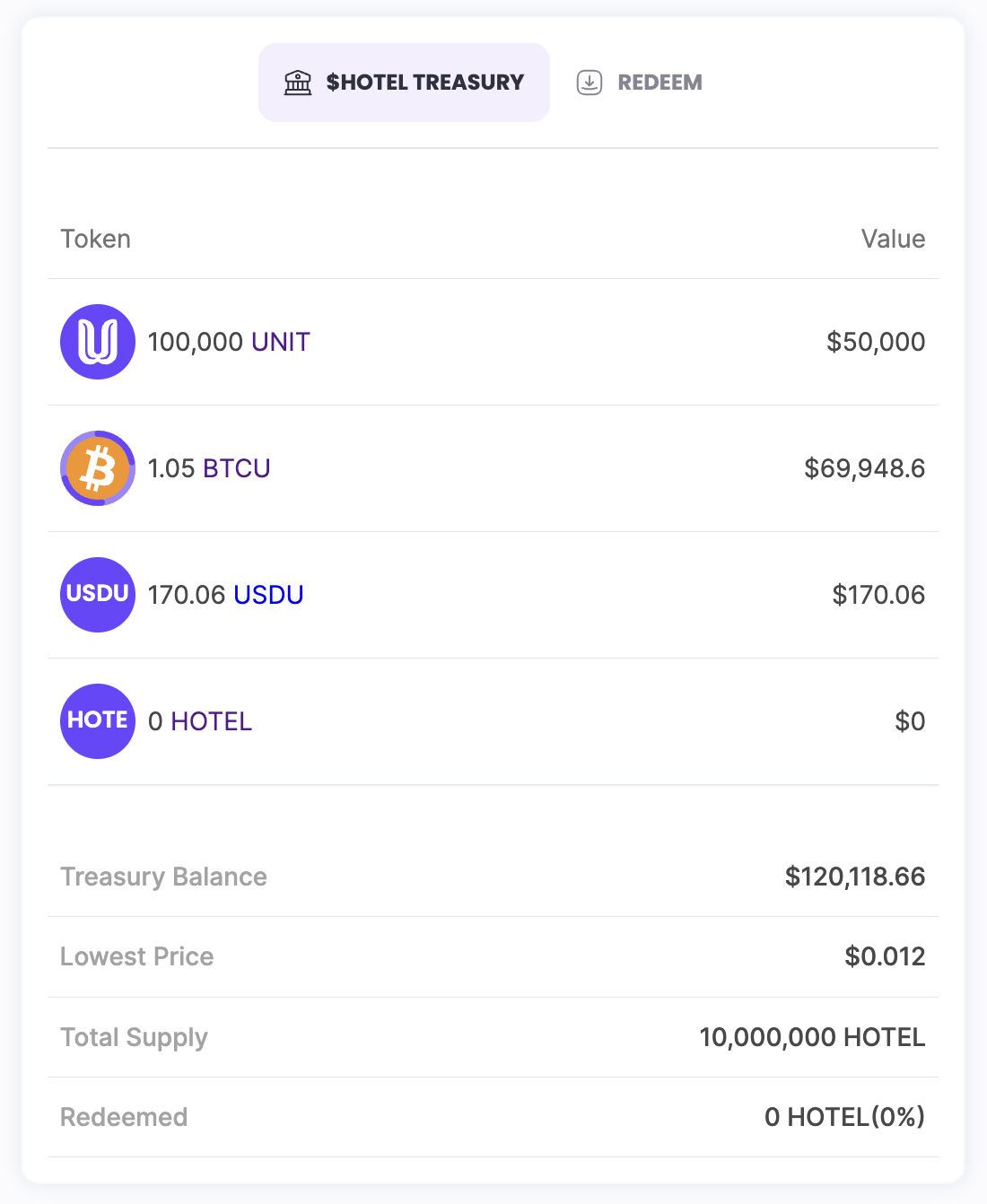

Treasury Overview panel

A list of all the tokens held in treasury is shown in the Treasury Overview panel.

Token burnt

Native token (private token created) sent to its own treasury are burnt.

In this example, you will see there are 2,000 symphony tokens sent to the symphony treasury. The value of these tokens ($10,657.35) are not included inthe treasury balance and the quantity (2,000 symphony tokens) are burnt, and therefore deducted from the total supply.

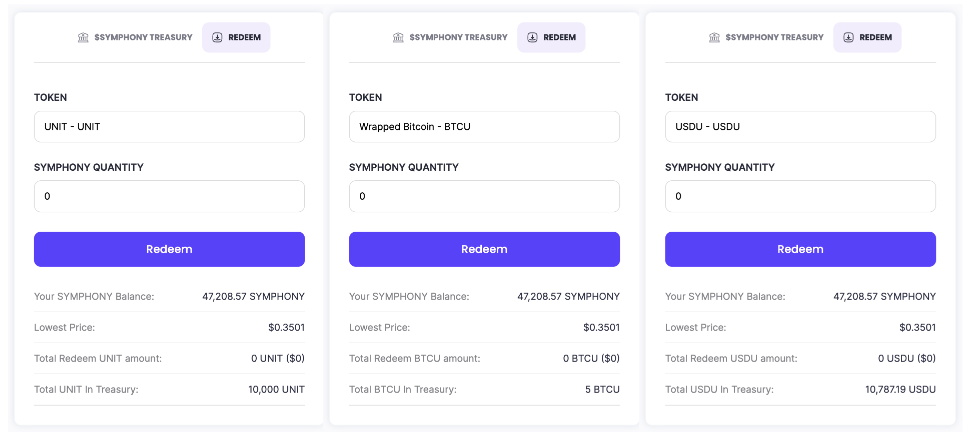

Treasury Overview - REDEEM panel

Tokens deposited in the treasury can ony be redeemed by token holders, based on how many tokens they own.

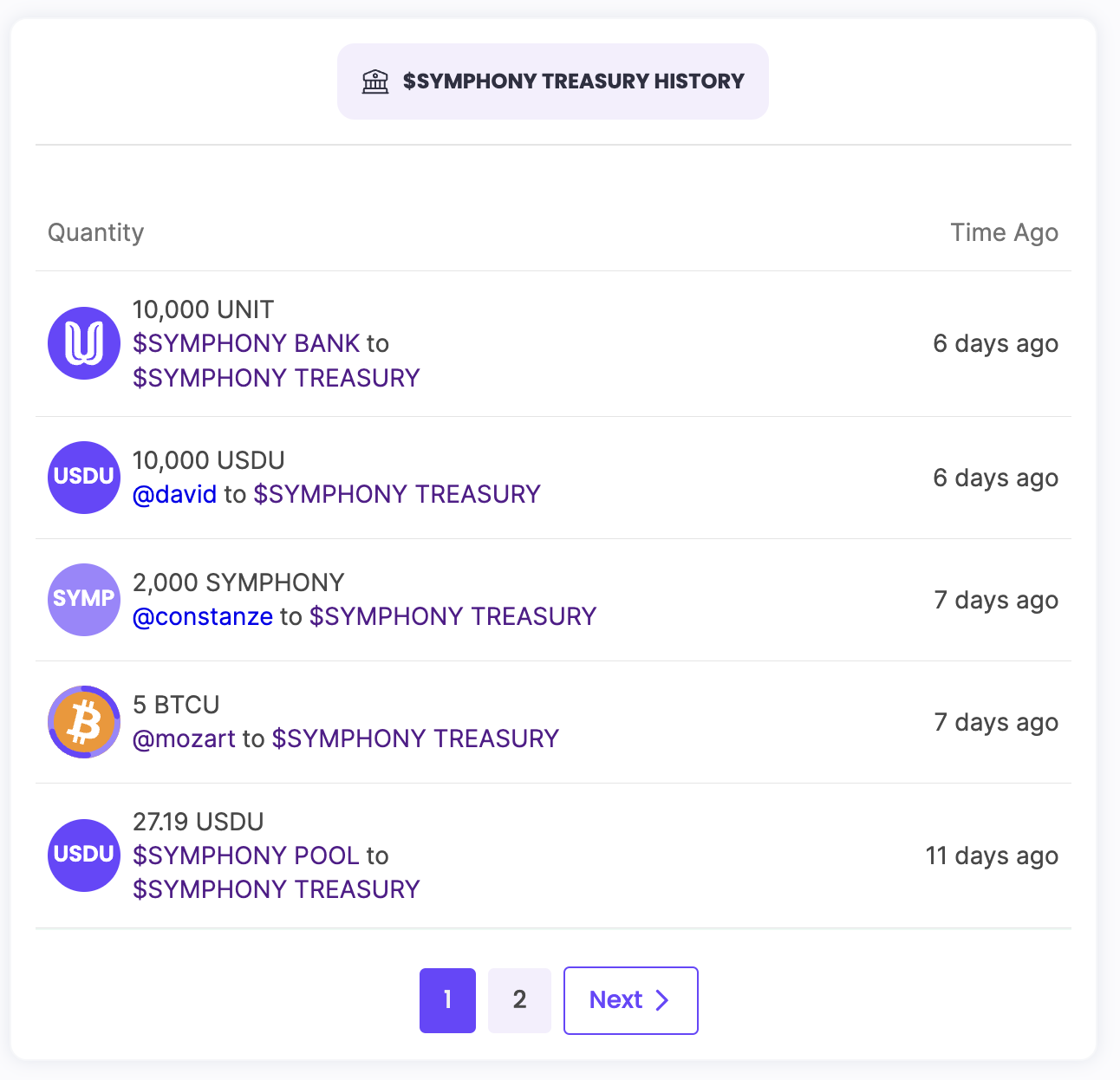

Treasury History panel

The Treasury History panel lists all the deposits into the Treasury.

Examples of deposits into the treasury:

- Exchange transaction fees

- Profits from a business

- Sales transactions

- Native tokens sent are burnt

Treasury Transfer concepts

Exchange transaction fees

Exchange transaction fees are incurred when there are BUY/SELL transactions involving the native token (symphony). The fees are sent to the treasury.

Profits from a business

The concept here refers to when a user creates a token for a business. The token may be used in the course of the business, and when there is profit made, it is accumulated in the Bank. However, to create more confidence in the token, the token owner can choose to send the profit gained to the treasury providing a higher floor for support for the tokens. This will enable potential investors to have more confidence in the token in their decision to invest in the token.

Sales transactions

The concept here refers to token owner selling a product.

For example, you have an online yoga class. Interested clients need to buy your $TOKEN monthly as a subscription service to join the class. There are two parts to this transaction, the client will use USDU to buy your $TOKEN, and when they pay for the monthly subscription, the $TOKEN is sent to the treasury (where it is burnt).

Native tokens sent are burnt

When native token (in this case Symphony token) are sent to treasury, they are burnt and removed from the total supply.

This happens when investors or token creator wants to reduce the market supply of the tokens, which will have an effect of increasing the token value.